A bridging loan is a short-term finance facility up to 12 months, used to bridge the money gap when buying a new home before selling the current home. They range from £50,000 to £500 million and are secured against property in good or poor condition.

When compared to mortgages they are much quicker to arrange and not so dependent on income or credit history.

These days, due to their flexibility over other finance facilities, bridging loans are used to fund property refurbishment and restoration projects. Due to being fast to arrange, they are also popular for buying properties at auctions, where speed is usually essential.

They are sometimes referred to as swing loans or gap finance.

We have access to all the best bridging loan providers, plus a range of exclusive facilities that are useful for applications that fall outside general lending criteria.

"At KIS Bridging Loans we will take the time to fully understand your plans and finance requirements, before finding the best possible deal on the facility that is best suited to your requirements."

As specialist bridging loan brokers we arrange the best possible finance facilities for all our clients.

Our bridging loans are the most competitive in the country!

A bridging loan uses the equity in a property as security for a secured borrowing facility. Unlike other secured loans and mortgages, a bridging loan can be set up quickly and can also make use of property that would normally be considered unsuitable security by many lenders. For example properties in a poor condition, or those without kitchens or bathrooms.

It is important to remember that bridging loans are a short term finance option, so should not be taken out over long periods. As a short term method of finance they have advantages over other funding methods because:

Regulated Bridging Loans

These are for loans that are secured against residential property (ie. Houses and flats), or building plots, where the borrower, or any of their immediate family, currently reside, or plan to reside in the future.

Unregulated Bridging Loans

Unregulated loans are secured against residential investment properties (ie. buy to lets and HMOs), commercial and semi commercial properties, development land, land without planning permission and agricultural land.

The vast majority of bridging lenders are unregulated, meaning they are not authorised or regulated by the Financial Conduct Authority. They are still able to lend but are restricted to only being able to provide unregulated bridging loans.

The lenders who provide regulated bridging also provide unregulated facilities. Whether or not a bridging loan is regulated or un-regulated depends on who might be living at the property being offered as security. If it is the borrower, or a close member of their family, then the loan will need to be regulated.

In addition, if the borrower does not currently reside at the security property, but has plans to in the future, then this will also mean that the loan will have to be regulated.

Some lenders may insist that a loan is written on a regulated agreement if the borrower does not reside at the security property but has done in the past.

A lender is required to be authorised by the Financial Conduct Authority in order to provide a regulated bridging loan.

There are far fewer bridging lenders in the market place able to provide regulated bridging loans than there are providing unregulated bridging facilities.

We estimate that only 1 in only 12 bridging lenders are regulated by the FCA

There is a good choice of regulated lenders providing loan facilities ranging from £50,000 to £5 million, with 12 month terms (1 month minimum term) and offering rates ranging from 0.47% to 0.59% per month for loans up to 55% Loan to Value.

In addition, there are some specialist plans that allow facilities of up to £20 million, loan terms of up to 24 months, monthly rates as low as 0.39%, no maximum age for applicants, plus other specialist underwriting. Please email or call us anytime for further information.

Regulated bridging loans can be used for many purposes when a short-term finance is required. Most people associate bridging being used to fund the purchase of a new property before the current one is sold.

This is still a very popular use, and are often used to help with downsizing, upsizing, buying a retirement home, or a property abroad. They are also commonly used for self builds, buying a property in need of repair as a restoration project, building projects, business uses, paying debts, stopping repossessions and solving probate issues.

Properties can be in a poor state of repair and unfit for mortgage purposes.

The vast majority of our regulated bridging loans are set up on our platinum plans with a 12 month term.

On the platinum plans the minimum loan term is 1 month, meaning if you repay the loan within the first 30 days, you will be charged interest for the full month. However, after 1 month, interest will only be charged up to the day that the loan is repaid.

With regulated bridging loans there has to be a clear exit route. Some lenders will only accept sale of a property as the method of repayment, but most will also accept refinance.

When the planned exit route is refinance, it is important to ensure that there is a refinance option. For example, a bridging loan could be used to finance a self-build, then once the property has been completed a re-mortgage used to repay the bridging loan. It is essential to check that a re-mortgage will be available once the property has been completed, otherwise the bridging loan won’t be repaid as planned.

There are many options for unregulated bridging loans. Lenders range from private individuals who lend out their own money, or have some other source of funds, to banks and other large institutions. Wherever possible it is advisable to borrow from an FCA registered and/or a reputable lender.

There are hundreds of bridging loan lenders, all of whom able to provide unregulated loans. They will lend to purchase or refinance:

A bridging loan is ‘unregulated’ when the property being used as security is for business or investment purposes which will never be occupied by the borrower or any member of their immediate family. A bridging loan also becomes unregulated when it is taken out under the name of a company/business, instead of a person.

We keep the whole process of obtaining a bridging loan as simple as possible.

Free advice > Decision in principle > Indication of terms

Phone our friendly bridging team, all of whom have considerable experience arranging bridging loans, to discuss your requirements. We will offer free advice, a decision in principle and an indication of all the costs.

Usually within 1 to 2 hours

Once we have an acceptance we will email you at least one detailed market leading quote.

If you are happy with the terms then we can instruct valuation(s). The majority of loans require a valuation to be carried out on the security property, although a valuation is not required on many plans.

If a loan needs to be paid out quickly, the legal work can be instructed at the same time as the valuation. Alternatively, this can be delayed until after the valuation, or until a time closer to when the loan funds are required.

Also know as Completion or Payout

Once the loan is ready funds can be release immediately or when required.

These are typically used by individuals and businesses who require fast short term finance, and use commercial property as their security.

Commercial bridging loans are often used to...

Proof of income - Bridging finance is looked at differently compared to other mortgages and property-backed loans. This is due to not having to make monthly repayments on a bridge, therefore the importance of income, affordability and credit history is not assessed in the same way.

However, although being able to afford monthly interest repayments on a bridging loan is not an underwriting consideration for loans where interest is added monthly, retained or deducted, it may still be an underwriting consideration when the bridging exit route is refinance.

This is because the proposed refinance will most likely have income requirements. You need to ensure that a refinance facility to exit the bridge is achievable, before taking out the bridging loan.

For example: You want a bridging loan to buy a property that is in such a poor state of repair it is un-mortgageable. Once you have purchased the property and renovated it, you intend to refinance the bridge with a buy to let mortgage.

In this example you need to make sure that you will be able to obtain a buy to let re-mortgage once the renovation work has been completed. Therefore, the only reason why you are not taking out a buy to let mortgage when purchasing, is due to the poor condition of the security property, which once repaired will then be suitable security for the buy to let mortgage company.

What do you need the money for? - The lender will need to know what you intend to use the money for. Bridging can be used for any legal and reasonable purpose, but the lender will need to be satisfied with your intended use for the loan.

What are you going to use as security? - One of the most important factors when it comes to bridging is what the loan will be secured against. Bridging loans can be secured against:

Loan to value - Typically, bridging will allow you to borrow up to 75% loan to value (GROSS) which means you can borrow up to 75% of what the security property or properties are worth. This includes and fees and interest that have been added to the facility. There are a few facilities that will allow up to 80%, but these do tend to be very expensive.

You can also use more than one property as security for a bridge if one property is not enough to raise the money required

What is your exit strategy? - The other most important requirement is your planned exit strategy for the bridging loan. Remember that bridging is intended for short-term use, so you need to have a failsafe exit strategy lined up.The most common bridging loan exit strategies are:

Other exit strategies could be a guaranteed return on investments, repayment of money owed, pending divorce settlement, pending inheritance, etc.

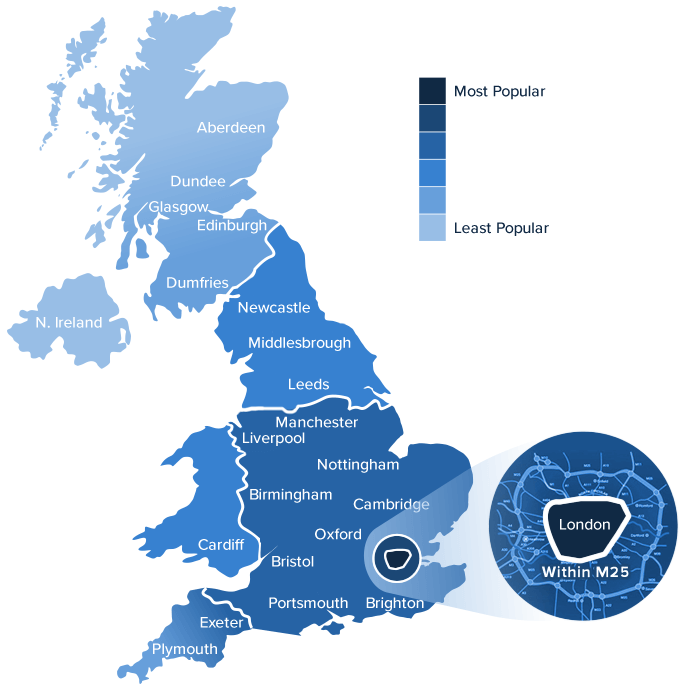

You may be surprised to know that there are a very small number of bringing loan lenders who will lend anywhere in the UK. In practice there are some areas of the country where many lenders don’t currently operate.

Most lenders prefer to lend in urban areas, with fewer operating in more rural locations. Only a small number of lenders will lend in Northern Ireland, whilst many won’t lend in Scotland other than in close proximity to large cities.

The area where there are the most bridging lenders wanting to lend is London and within the M25. The area with the least is rural Scotland, Northern Ireland and the British Isles.

The map below illustrates the popular areas for the bridging lenders in the UK to lend.

Before taking out any type of short term finance you need to make sure that you have an exit strategy for how you are going to repay your loan back at or before the end of its term.

Closed bridging loans

If the loan is to be repaid on a set date, for example from the sale of a property where contracts have already be exchanged and a completion date set, or from the proceeds of an investment policy due to mature on a specific date, then this is known as a closed bridging loan.

Open bridging loans

However, if there is no firm date on which the loan is to be repaid, for example the exit route is the sale of a property that hasn't yet got a buyer and could sell anytime within a week to a year, this is known as an open bridging loan.

The lenders do prefer closed loans, but for most applications these days it doesn't make that much difference with regards to finding a facility, rates and costs. This is because the bridging market is currently very competitive.

Written By Holly AndrewsLast updated: 22 November 2023 | © KIS Bridging Loans 2024