The National Fraud Intelligence Bureau (NFIB) has recently issued warnings of scam calls that appear to be coming from a number very similar to the victims’ own numbers. Action Fraud received 2,110 reports of these scams calls in May this year.

Typically, the first seven digits of the number match the victim’s number which is in a bid to throw people off and answer. The scammers are posing as government officials or law enforcement agents and are accusing people of unpaid fines and police warrants. They are asking the victims to ‘press 1’ in order to speak to a police officer or advisor to get the situation sorted.

Once you interact with the caller and press 1, this is likely to start adding high charges to your phone bill. They may also try and obtain your personal information and bank details by saying that a fine needs to be paid.

It’s important to remember that you should never give anyone your details over the phone, no matter who they say they are. The government or police would never inform you of fines or warrants over the phone or via text message.

New research by Citizens Advice has found that more than two thirds of adults in the UK have been targeted in some way by a scammer so far this year.

Although those aged 55 and above are most likely to be targeted, those aged 34 and under are almost five times more likely to fall victim.

Out of those who said that they had been targeted by a scammer;

Scam reports have been increasing sharply during the first half of this year when compared to the same period of 2020. The number of scam reports to Citizens Advice has risen by 123% in the 5 month timeframe.

In the 12-month period between 30th April 2020 and 30th April 2021, HMRC responded to over half a million reports of tax rebate scams.

During the same period, HMRC worked with Ofcom and other telecoms companies to remove over 3,000 malicious phone numbers and they also worked with internet service providers to take down nearly 16,000 malicious websites. Phone scams were up 135% on the previous year, with 443,033 reports.

These scams aim to trick those who are doing their tax credits renewal into handing over their personal information and bank details. The scammers will usually ask for bank details so the tax credits can be transferred to you, or they will ask you to transfer money after claiming that you were given too much.

How to protect yourself:

Since the start of the pandemic last year, fraud and scam figures have soared as we move more and more aspects of our lives online.

According to Action Fraud, over £63 million has been lost through investment scams during a 12 months period. All of these reports made reference to social media platforms (most commonly Instagram, followed by Facebook) in that the victims were either contacted directly by scammers through the platform, or they were drawn into an advertisement.

Scammers have also been using images of well-known, trusted social media influencers without their permission to make it look as if that person endorses the investment opportunity. Between April 2020 and March 2021, Action Fraud received over 500 reports of investment fraud where the scammer promoted fake celebrity/influencer endorsements.

44.7% of the reports said that they were tricked into investing in a type of cryptocurrency, but other reports mentioned foreign exchanges and bonds.

How to protect yourself from online investment scams:

According to Action Fraud, 107 reports of pension fraud were received in the first three months of this year. This is an increase of nearly 45% when compared with the same period of 2020.

Pension scams usually include ‘too good to be true’ investment opportunities, free pension reviews, or offers to release cash from your pension pot before you’re 55.

Scammers may contact their victims through phishing emails and text messages, but the most common method for these types of scams is cold calling.

The scammers will put you under a lot of pressure and will try to keep you on the phone instead of allowing you time to go away and think or seek advice. They may even pose as your pension provider and say that you must do what they’re telling you otherwise you could lose your savings.

Pensions scams are hugely damaging both financially and emotionally with some victims losing their life savings to these criminals.

How to protect yourself from pension scams:

Scammers have been taking advantage of the pandemic since the very beginning, and now that we’re coming out the other side, the easing of restrictions is providing yet another opportunity for scammers to con people out of their money.

As we’re getting closer to May 17th , the next step in the government’s easing of lockdown, plan, people have been rushing to book holidays and tickets to concerts and festivals. Scammers have been taking advantage of this with scams that include fake ticket sales, fake hotel bookings, and fake travel insurance.

They have created fake websites and are promoting them online, but other tactics being used are phishing emails, social media posts, and cold calls.

Things to remember:

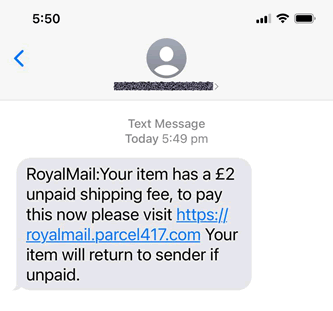

Fraudsters have started to send out new text message scams pretending to be from Royal Mail.

The messages come from a normal/unknown mobile phone number. Legitimate text messages come from RoyalMail with no phone number displayed.

The text that we have seen says “Royal Mail: Your item has a £2 unpaid shipping, to pay now please visit (scam website). Your item will return to the sender if unpaid.”

If you click on this link then you will be taken to a scam website where you are asked to enter your bank details in order to pay the fee. After you’ve done this and the scammers know what bank you use, they will call you pretending to be from your bank’s fraud department.

The scammers will tell you that you’ve fallen for this Royal Mail scam and that scammers have tried to set up direct debits in your name or make large payments from your account. They will then say that they’ve issued you with new bank cards and a new sort code and account number, as well as ask you to transfer all of your money to a new account which is controlled by them.

This is known as a ‘safe account’ scam. For more on information on safe account scams, please read the following article: What is a ‘safe account’ scam and how to protect yourself

Every adult in the UK can now order packs of free rapid lateral flow tests from the GOV.uk website to do at home instead of having to go to a test site. This is very good news in terms of progression in the fight against the pandemic, but this is bringing up concerns about potential scams.

Scammers have taken full advantage of this pandemic ever since the start by praying on people’s worries and concerns. There’s no doubt that they will now be focusing on creating fake website to try and trick people into ordering and paying for fake lateral flow tests.

This is the only website that you should be ordering lateral flow tests from:

https://www.gov.uk/order-coronavirus-rapid-lateral-flow-tests

You do not have to fill in any payment details as the tests are free. You only need to enter some personal details and your delivery address.

If you’re on a website that asks for you to pay for tests then leave the site immediately and report it to Action Fraud.

Over the last month there have been several reports made to Action Fraud regarding a National Insurance number cold call scam.

Scammers have been sending out automated telephone calls to people which tells them that their National Insurance number has been compromised. In order to fix this issue and get a new National Insurance number, the message asks you to press 1 on your handset to be connected to the caller.

Once you’re connected to the caller, you will be pressured to hand over your personal details so they can issue you a new National Insurance number. In reality, these scammers are just trying to get your details in order to steal your identity and commit further crimes.

How to protect yourself from this scam:

Whenever you receive a call that’s just an automated message, hang up immediately and don’t do anything that they tell you to. Once you’ve pressed the digit that they requested, you will either be connected with a scammer or it may add expensive charges to your phone bill.

Never give your personal details to anyone over the phone. If you’re concerned about your National Insurance then you can go to the Gov.uk website and receive advice for free.

As lockdown restrictions start to ease across the UK and with demand for event tickets starting to grow, the National Fraud Intelligence Bureau (NFIB) are warning the public over

rising ticket fraud.

In February 2021 Action Fraud received 216 reports of ticket fraud, including both fake tickets for genuine events and tickets for non-existent events. This was a 62% increase on the number of reports in January 2021 and the highest number of reports received since March 2020.

How to protect yourself from ticket fraud:

Find it useful? Please share!

Find it useful? Please share!

Last updated: 19 April 2023 | © KIS Bridging Loans 2024 | Terms & Conditions