The Chartered Institute of Housing has expressed concerns that the ongoing loss of council properties is continuing to impact on the affordable housing crisis, as social housing is not being replaced fast enough. The decision in June 2022 to extend the Right to Buy to housing association properties has further impacted the stock of affordable housing, with up to 2.5 million tenants potentially benefiting from the scheme.

The new Right to Shared Ownership scheme, which came into effect in December 2022, will see a further erosion of the stock of affordable housing. Under the initial scheme tenants in properties built under the government’s Affordable Homes Programme 2021-26, can buy a share in their property worth between 10% and 75%. The plan is to extend this to more tenants in the coming years.

With little chance that the same number of homes will be built to replace the lost stock, we are likely to see a further reduction in the stock of social housing. At KIS Finance we have looked into the story behind the gradual selling off of social housing stock and how for some tenants, the decision to buy has turned them into property millionaires.

When Margaret Thatcher introduced the Right-to-Buy scheme in 1980, her vision was that more people could own their home. The large discounts offered made this possible for many people who would otherwise not have had the opportunity.

Home ownership was encouraged, and it was believed that if this was sought after and achieved, it would raise the expectations of those on lower incomes to further look to improve their quality of life.

However, 40% of council houses sold under the scheme in London are now rented out privately. This goes completely against the original intention of home ownership by allowing people to turn the scheme into a money-making business opportunity.

This has also made the rental market far more expensive for potential tenants, as the average rent charged by private landlords across England is £1,162 per month, compared to just £410 for a council property. This rockets to an average price of £2,343 in London, which is over 4 times the average amount charged by the Local Authority (£505).

On top of the price increase, this has also led to much less security for tenants. Whereas council tenants know that they have the security of their home for many years, private landlords can give you just two months’ notice to leave.

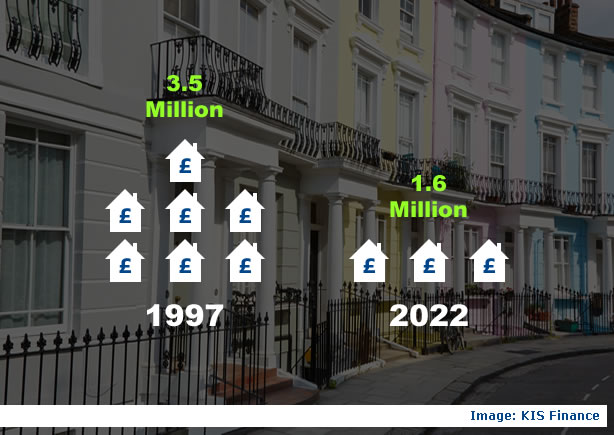

Back in 1979, 42% of people living in the UK lived in council homes. Since 1980 council and social housing tenants have been able to purchase their homes through the ‘Right to Buy’ scheme at a discounted price. The scheme was introduced as an opportunity for tenants to improve their financial situation, and since it started, just over 2 million council homes in the UK have been sold to council tenants.

When the Right to Buy scheme was first introduced 42 years ago, provided a person had been a council or social housing tenant for at least 3 years, they could purchase their council home at a discounted market value.

The Right to Buy rules and discounts have varied over the years and also for different parts of the country. In England and Wales, back in the 1980s and 1990s, council tenants could apply for the Right to Buy their council property. The council would value the property and apply a discount, which would be dependent on how long the applicant had been a council or social housing tenant. Back then many people qualified for the maximum discount, which was 60% for a house and 70% for a flat.

An added bonus was that, since mortgage companies were taking a charge over a property worth a lot more than the purchase price, they were more than happy to lend 100% of the purchase price. This meant that tenants could buy their home without having to find a deposit, replacing a rental payment with an often much smaller mortgage payment. From the mid-1990s, some mortgage and bridging loan companies would even lend amounts over the purchase price, providing additional funds for home improvements and other uses.

Even with borrowing the extra funds, most people who purchased their council property had a monthly mortgage payment that was no more than their rent.

However, due to significant increases in property prices in some areas, in particular many parts of London, the rewards for some of those who purchased their homes have been huge. Consequently, there are now hundreds of ex-council tenants who, due to taking the step and buying their council property, have since become property millionaires!

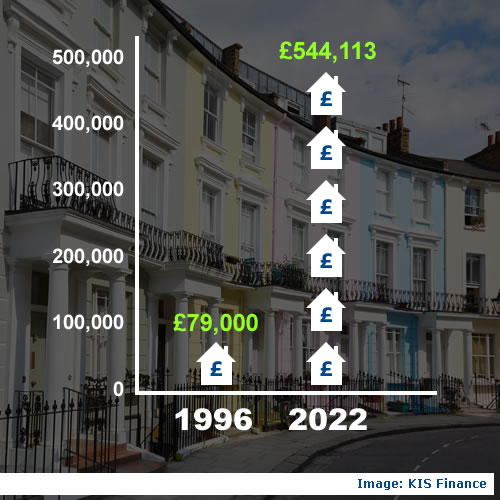

It is no secret that property prices have rocketed in London. According to Savills, the average amount paid for a property in London in 1996 was £79,000. In 2018 the average had increased over 6 times to £478,853 and by 2022 this had risen to £544,113! The most expensive areas in London are Westminster, Kensington and Chelsea. The cheapest property on the market at the moment in Westminster is £350,000 - and that will only get you a studio apartment! According to Zoopla, the average price for a property in Kensington and Chelsea is around £2,409,002.

Right to Buy sales peaked in London in 1990 when 26,260 council homes were sold in that year alone.

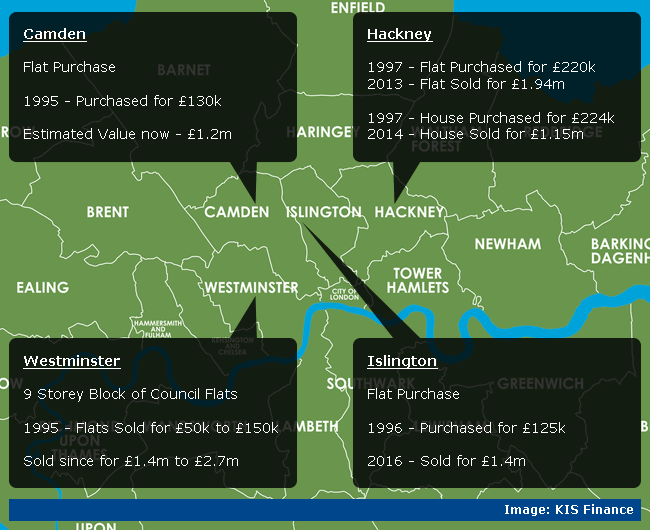

Council tenants who purchased their flats in a 9-storey block in Clarendon Place, Westminster, have done particularly well. Some three-bed flats, that were once owned by the local authority, have sold within recent years for £2.25 million and £1.8 million. Another of the flat owners in the same block managed to make a profit of over £1.6 million, when they sold it just 6 years after purchase.

Other Londoners have done well too. Over in Hackney, ex-council houses in Shepherdess Walk have been sold for between £1m and £2m. One property was purchased for £171,000 by the tenant in 2000 and later sold for £1m in 2014, whilst another was purchased through the Right to Buy scheme for £220,000 in 1997 and later sold in 2013 for £1.94m.

Falmouth House - a 9 storey council block with 45 flats

The council sold flats in 1995 ranging from £50k to £150k (after discount).

In 1997 they sold a flat for £100k, another for £145k in 2000 and also £176k in 2011, all under Right to Buy so were at discounted purchase prices.

Flats in this same block later sold for:

£1.895m in 2013

£2.1m in 2014

£1.85m, £2.25m and £2.7m in 2015

and for £1.825m in 2016.

A flat in Middlesex Street was purchased for £125k after discount, then sold in 2016 for £1.4m

In Shepherdess Walk a terraced house purchased under Right to Buy for £120k in 2000 and was worth over £1.4m in 2017.

Same area a flat purchased from the council for £220k in 1997 sold in 2013 for £1.94m. This is an average increase of over £100k per year, tax free!

A flat in Branch Hill was purchased after discount for £130k in 1995, and another in the same block for £240k in 1996.

In 2014 a flat in this same block sold for £1m.

Tenants who purchased their homes on London's largest council estate in Dagenham, will have also seen the value of their home multiply over the past three decades. However, any profits made are much less than some other parts of London.

To compare with Westminster in 1995 - a 2 bed house in Dagenham was purchased for £45,000 and was sold in 2007 for £166,500. A similar house on the same street sold in 2022 for £325,000.

Although the price has increased by more than 7 times since 1995, the rate of increase has not kept up with Westminster.

The lower purchase prices also mean a lower net profit, so although there are no property millionaires here, most tenants who purchased their properties have still done rather well.

Anyone who bought their council home in Byker, Newcastle may struggle to afford a home anywhere else due to the minimal property price increases, which have definitely not kept up with other areas.

A flat bought for £23,500 in 1999 sold for just £64,000 in 2021. Based on the increase in value of just £2,000 a year, should the flat need any money spent on it then the buyers may be regretting their decision.

Over the years, the discounts available and term of residency needed to qualify for the scheme have varied. Currently, the maximum discount available is up to 70% of the property value, or a maximum of £87,200 (£116,200 in London). The scheme is now only available in England after being abolished in Scotland in July 2016, and January 2019 for Wales.

The number of right to buy purchases peaked in 1988 – 1989 at 135,701. This figure has dropped substantially to 10,878 sales in 2021/22. However, with the extension last year for the right to buy housing association properties and the recent introduction of the Right to Shared Ownership scheme, the concerning trend of a an ever-reducing social housing pool of properties looks likely to continue.

Find it useful? Please share!

Find it useful? Please share!

Last updated: 02 March 2023 | © KIS Bridging Loans 2024 | Terms & Conditions