Independent development finance brokers providing mezzanine finance for projects throughout the UK. Various mezzanine funding options up to 90% LTV. We have a panel of niche funding providers and investors that enables us to quickly source the required funds:

This is a funding facility used mainly by property developers to finance part of a building development project’s costs.

Funds are released to property developers as work on the project progresses and as they are required. Mezzanine funding is normally secured as a second charge behind the project’s main lender for the development.

Mezzanine lenders will invest in a development project usually on the understanding and agreement with the developer that they will receive their initial investment back plus a small amount of interest, in addition to an agreed percentage of the development’s profit. Alternatively they may just charge a higher rate of interest or have an agreed fee.

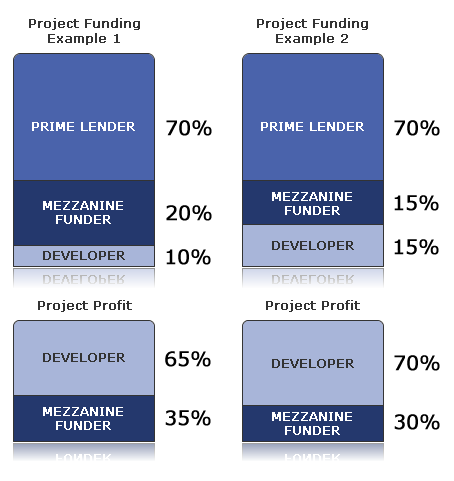

The above diagram illustrates that the greater the ‘proportion’ of finance put in by the mezzanine finance provider, then the greater the share of the profits that they will require. This is because of the increased risk that they are taking.

Mezzanine development finance works to bridge the gap between a development loan and the amount of funds that the developer has to put into the project. The Mezzanine funder will usually take a second charge on the development, sitting behind the first charge of the ‘senior debt’ loan provider.

Mezzanine funding can help to reduce the amount of deposit that a developer has to raise to get their project off of the ground.

Typically facilities start around 1% per month with 2% facility fee and a 1% exit fee

Rates will vary between lenders, but most Mezzanine funding will be priced on a per project basis. Various factors will affect the cost, including:

Mezzanine funding providers tend to restrict their lending to experienced property developers who have a history of successful projects, and with whom they feel confident with. This is obviously important since type of funding provides high loan to value lending, but they also need to be sure that a primary lender will also be happy to lend.

The primary lenders are going to be more open to lending if the developer themselves is putting in a large chunk of the capital required to fund the project. When capital is being provided by mezzanine funding, even though this is charged behind the primary lender’s interest, they will become nervous. This is because if things start to go wrong it is easier and more likely for the developer to walk away from the project than if they themselves had a large chunk of money invested. Therefore when mezzanine funding is being provided the primary lenders are also very concerned about the experience and ability of the developer.

Joint venture funding, also known as JV finance, is an excellent alternative to mezzanine finance. This enables developers to raise additional finance up to 100 percent of a project’s total cost.

The joint venture finance providers are keen to invest in projects that have a high potential of being profitable. In return for their investment they may ask for a share of the development profits, charge an exit fee or enter into some other type of profit sharing agreement.

This type of finance is an excellent option for projects where the developer has little or no capital available to put in themselves.

Please contact us for more information about development and mezzanine finance.

Last updated: 22 November 2023 | © KIS Bridging Loans 2024